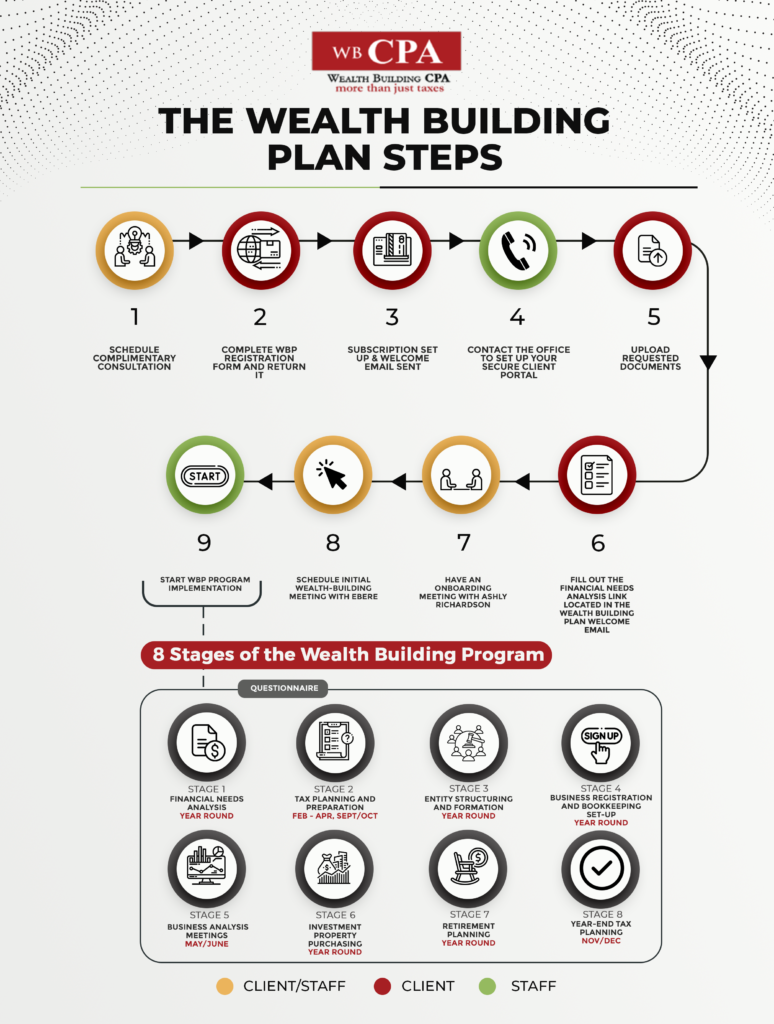

The Wealth Building Program is a 12-month training program that takes you step-by-step through the steps required to run a successful and efficient business.

I’ve developed this system after years of working with business owners on how to best use their professional skills, passion, and experience to pursue their entrepreneurial dreams. This program focuses on a specific element of the Wealth Building System – Tax Planning, Tax Preparation, Entity Structuring, Business meetings, etc. At the end of the 12-months, you’ll be in a position to operate a successful business. SCROLL DOWN TO SEE A FULL BREAKDOWN OF WHAT YOU GET.

Ebere representted a client at an IRS Audit and reduces his tax liability from $22,000 to $1,365! The client said: “I attempted to fight it initially on my own and decided that this is something I definitely need to get my CPA in on … which is you Ebere ”

Let Ebere Okoye “Wealth building CPA” evaluate your financial and tax situation, then develop a customized tax strategy just for you. Together, you will come up with a strategic plan designed to answer your questions as you build your own customized wealth-building plan. With her help, you’ll develop a plan for a sustainable and profitable small business.

The Course Breakdown

During these 12 months, I’m going to work with you on all aspects of your finances that will reduce your chances of mistakes due to the chronic lack of communication and integration of services between your CPA, lawyer, tax and investment advisor.

Financial Needs Analysis Questionnaire

This is the piece that many people overlook. This stage will help you get clear about what you want out of life and determine what you will and won’t do so that you can build a business that is a good business for you. You will paint for us a current picture of where you are financially and where you need to be and with that, we can come up with a plan for the rest of the wealth-building program.

Tax Planning and Preparation

During this stage, Your tax returns for the last three years will be reviewed for accuracies, inconsistencies, audit flags, and potentially overlooked deductions. An important part of reduction planning is not wasting deductions or making certain elections to take advantage of unused deductions in the future or even carry them back to prior years. We will also prepare individual and business tax returns for the current tax year.

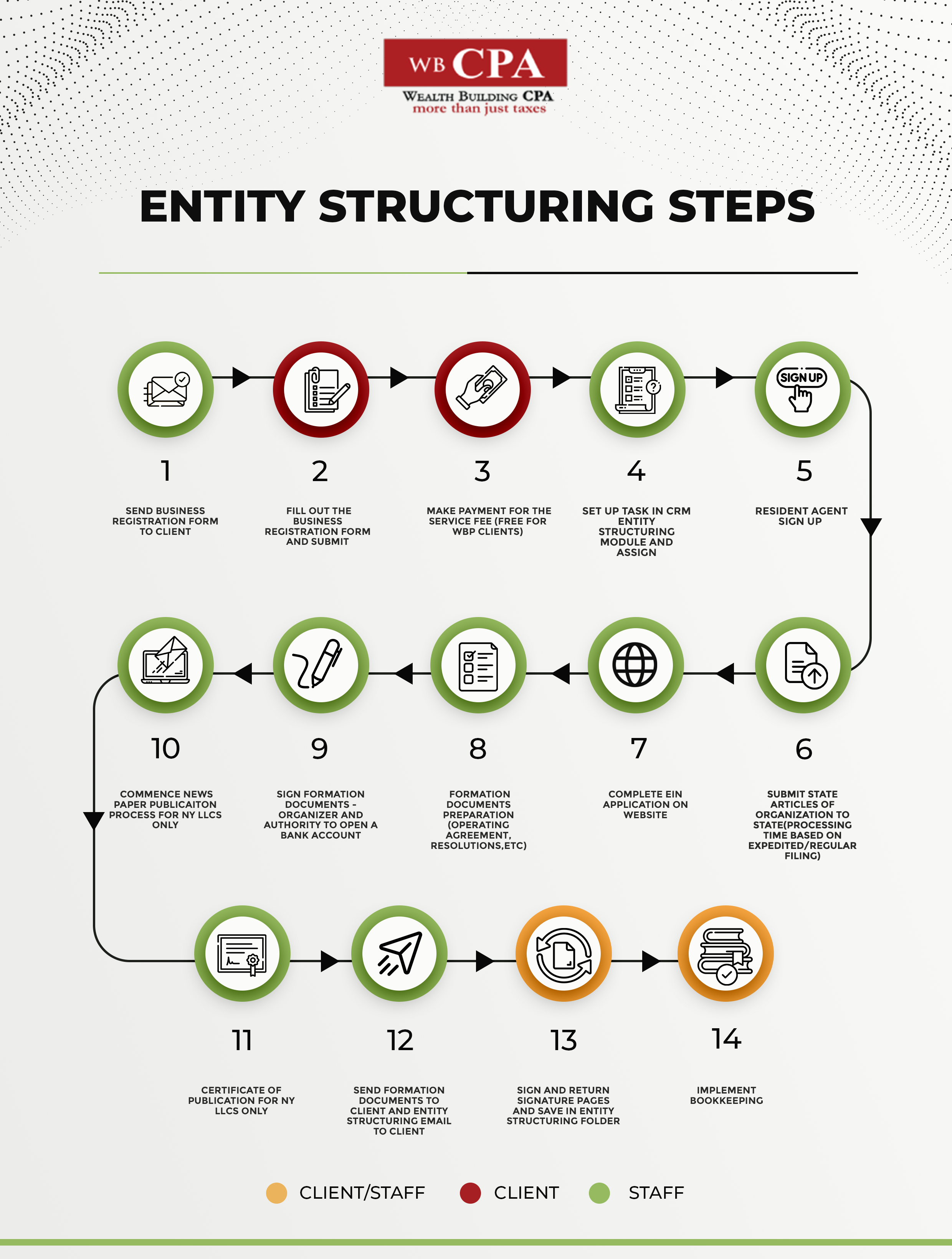

Entity Structuring

Entity structuring is the use of a legal entity in an effort to provide asset protection and tax mitigation. It is the essential framework used to help manage cash flow and to allow you to retain revenue that can be reinvested to continue wealth accumulation. Three factors to consider in forming an entity: Legal liability, tax reduction strategies, and ease of compliance. During this stage, we will look at your business strategy and match it to an entity structure that best fits. Many start-up entrepreneurs make the mistake of trying to go after too broad a market. I’ll show you how to develop a niche market for your business and then find a structure.

Business Registration and Bookkeeping Set-up

Once the entity structuring stage is complete, we will assist you with meeting with potential partners (if any), registering the company, getting operating agreements, EIN number from IRS, bookkeeping chart of accounts and discuss operations procedures.

Business Analysis Meetings

Most wealth privately held businesses form the “Alternative Board”. That’s why I offer my clients a business analysis meeting. During this stage, we

- Get crystal clear on how your business is doing today

- Identify where you want to go with your business in the future

- Discuss the steps you need to take and strategies you need to implement to get there

- Explore if a Smarter Small Business Coaching or Consulting program can help get you there faster

Investment Property Purchasing

During this stage, we will discuss the different real estate strategies available to you. Once you decide on the real estate strategy that works best for you, we will assist you in finding, funding, farming or keeping the property. We have a team of investment property experts that will assist you in finding the right property that fits your real estate strategy.

Retirement Planning

While all of us would like to retire comfortably, the complexity and time required in building a successful retirement plan can make the whole process seem nothing short of daunting. However, it can often be done with fewer headaches (and financial pain) than you might think – all it takes is a little homework, an attainable savings and investment plan, and a long-term commitment. We will assist you with coming up with the process needed to plan, implement, execute and ultimately enjoy a comfortable retirement. This stage is also integrated with other aspects of your wealth building program.

Year-End Tax Planning

Tax preparation for the April 15th return is not considered advance tax planning. It is merely tax compliance as opposed to voluntary tax reduction planning. Though returns aren’t due until April, they cover a tax year that ends Dec. 31. Some of the best tax-reduction moves really need to be done by mid-November or early December. They often take some advance planning. Getting a head start in September could make you a lot happier in April, giving you a bigger refund or a smaller check to write to Uncle Sam.

This stage does exactly that. You either pay the IRS, pay a tax preparer, or pay a qualified CPA to come up with some tax reduction strategies.

Don’t forget, when you join the program, you will have an initial phone consultation to determine which of these stages need to be implemented first. You do not have to follow the order prescribed above but can come up with a personalized wealth building program.

This program incorporates plenty of time for unlimited consultations with the CPA on any issues you have as you progress in your financial plan. So you’ll be able to ask as many specific questions as you like.

At the end of the 1 year, you’ll know exactly what you need to do to succeed in your small business.

HOW MUCH DOES IT COST?

The investment in the program is $3995, including a copy of Your Guide to Free Internet Resources for building your business.

(Note: Private sessions with Ebere are $225/hour)

WBP PLAN A – $3995, and you will get: (additional fees apply for investors with more than 4 businesses and 6 or more properties)

- Preparation of individual and business tax returns (Valued at $1299 + based on number of forms).

- Business Entity Structuring and Formation (Valued at $599).

- Personalized tax reduction strategies (Valued at $449).

- Newsletter of hot tax facts (Free).

- Asset and Portfolio Management (Valued at $449).

- Year-End tax planning (Valued at $995).

- Unlimited consultations with Ebere Okoye(Valued at $225/hour).

- Al Aiello’s “Package Deal” Money Savings Reports

Would you like a payment plan of 6 payments of $582.50? No problem! We can accommodate this as well.

Click Here to Contact Us Today or Call 888-502-3767!